Preparing for an inheritance

What role will an inheritance play in your long-term wealth strategy? If the ballpark numbers are at least remotely close, the amount of assets set to be transferred from one generation to the next in Australia over the coming decades will amount to trillions of dollars. According to estimates within a 2021 Productivity Commission report, Australians […]

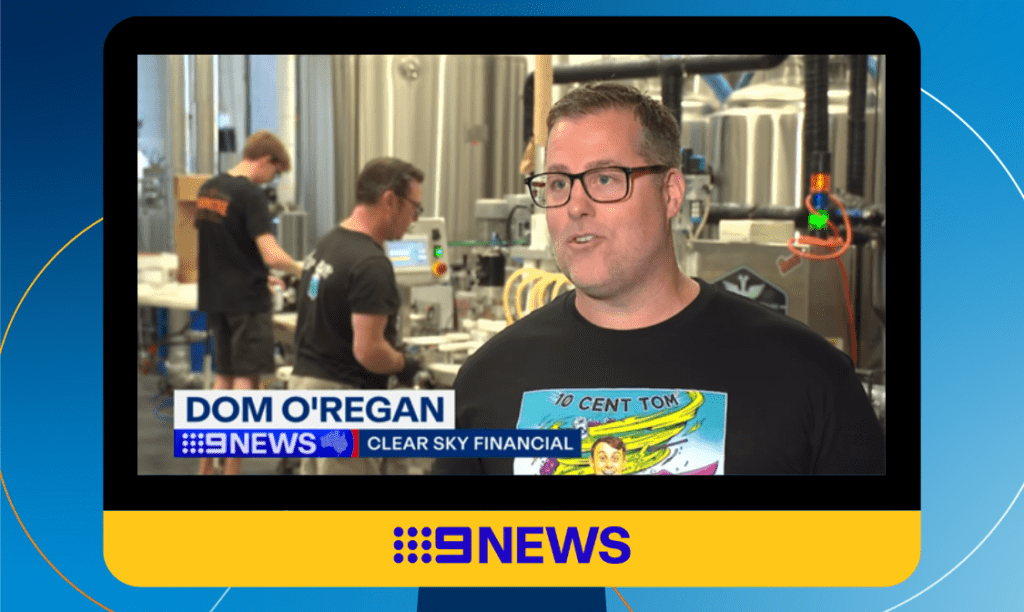

The team at Clear Sky Financial are extremely good at what they do and their customer service is amazing.