The many unpredictable events of 2024 could easily have been disastrous for investment markets. Instead, we saw remarkable resilience and growth despite occasional volatility, as investors reacted to the extraordinary times.

While economic growth in Australia and overseas was underwhelming, share markets rode out the ups and downs to finish 2024 strongly.

| Australia key indices December | Share markets (% change) Year to December | ||||

| 2023 | 2024 | 2023 | 2024 | ||

| Economic growth | 1.5% | *2.1% | ASX All Ordinaries | 8.4% | 7.5% |

| RBA cash rate | 4.35% | 4.35% | US S&P 500 | 24.2% | 23.3% |

| Inflation (annual rate) | 4.1% | ^2.8% | Euro Stoxx 50 | 19.2% | 8.3% |

| Unemployment (seasonally adjusted) | 3.9% | #3.9% | Shanghai Composite | -3.7% | 12.7% |

| Consumer confidence | 82.1 | 92.8 | Japan Nikkei 225 | 28.2% | 19% |

*Year to September, ^September quarter, #November

Sources: RBA, ABS, Westpac Melbourne Institute, Trading Economics

The big picture:

2024 was the ‘super election year’, when almost 2.5 billion people in 70 countries voted.i One result that has captured the attention of governments and analysts around the world is Donald Trump’s return to office in the United States. He has promised massive tariffs, tax cuts and increased spending on defence. All measures are likely to increase inflation and budget deficits, which will affect global markets and economies.ii

Australian and US inflation rates year-on-year % change:

Continuing geopolitical upheaval also marked the year. Tension in the Middle East grew as Israel expanded its campaign and European Union economies came under increased pressure when Ukraine stopped the flow of Russian gas.

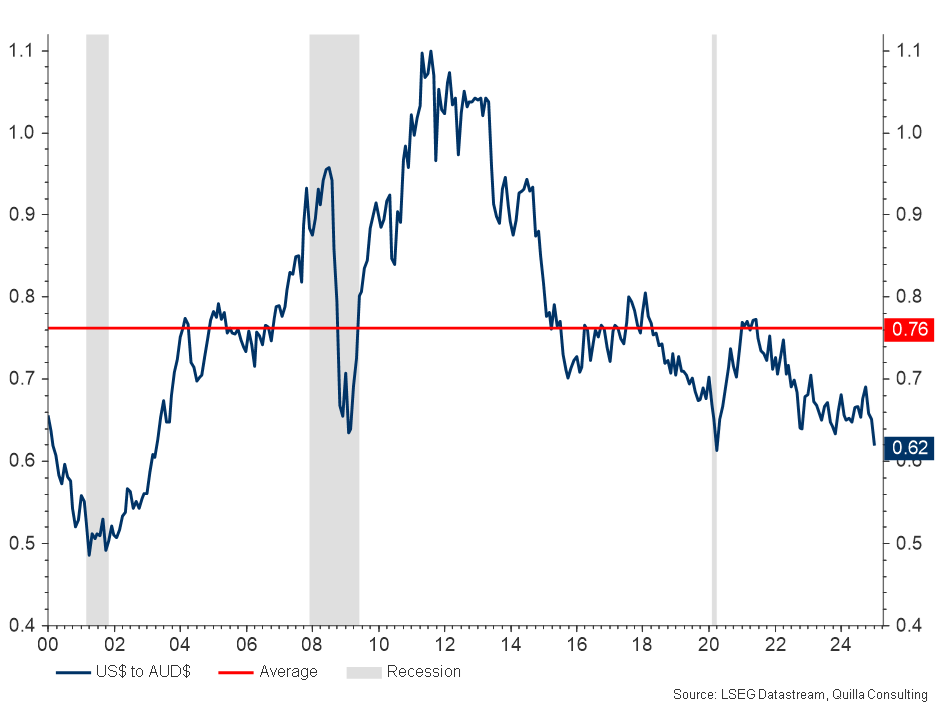

The US dollar ended the year on a two-year high but that, and a weakening Chinese Yuan, led to a two-year low for the Australian dollar, which ended the year just below 62 US cents.iii

Australian dollar to US dollar exchange rate – trading close to the bottom of the long-term range:

Cost of living falls but interest rates steady:

Around the world, interest rates fell during the year but in Australia, after five interest rate increases in 2023, the Reserve Bank (RBA) held steady at 4.35%, believing inflation is still too high.

Nonetheless, the cost of living has fallen significantly, down to 2.8% in the September quarter from a high of 7.8% two years ago and 3.8% in the June quarter.iv

Falls in electricity and petrol prices contributed to the easing.

Australia’s economy grew by 0.8% in the three quarters to the end of September – it’s slowest in decades.v

House prices mixed across the country:

The housing market appeared to cool by the end of the year, with average national home values falling by 0.1% in December to a median of $815,000.vi

CoreLogic’s Home Value Index data shows four of the eight capitals recording a decline in values between July and December. These included Melbourne, Sydney, Hobart and Canberra. While in Perth, Brisbane, Adelaide and Darwin, home values increased.

In annual terms, Australian home values were up 4.9% in 2024, adding approximately $38,000 to the median value of a home.

Share markets survive and prosper:

Global share markets were unsinkable in a year of stormy economic and political conditions.

While markets were volatile at times, the year ended with strong gains overall despite a disappointing December after a tech driven sell-off.

The Nasdaq surged more than 30% for the year. The S&P 500 was up 25% – pushed along by the ‘Magnificent 7’ tech stocks – and the Dow rose 14%.

*Magnificent 7 vs S&P500 earnings growth (YoY %):

*The Magnificent 7: Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, Meta

Although not quite in the same league, the ASX performed strongly, recording 24 new record highs during 2024. The S&P/ASX 200 closed the year at 8159, up 7.5%, with some analysts predicting 2025 will close around 8800.

Commodities:

Gold came into its own as a safe haven for those concerned about events around the globe, reaching an all time high in October and adding more than 28% for the year.

Oil prices were subdued with investors cautious about a glut, the risks of wider conflict in the Middle East, the war in Ukraine, and the change of government in the US. Although there is some optimism for improved growth in China in 2025.

Iron ore prices have continued to decline, now down to about half of the peak US$200 a tonne in 2021.

Looking ahead:

Economists’ forecasts vary on the timing of a cut in interest rates in 2025, but some believe there will be as many as four cuts, reducing the rate to 3.35% by year end. Although, as RBA Chief Economist Sarah Hunter points out, “All forecasts turn out to be at least partially wrong.”vii

Nevertheless, the RBA believes there is a high level of uncertainty about the outlook overseas.viii

For example, any move by China to increase spending or bolster its economy would likely lift demand for our exports and flow through to the Australian economy. The Trump administration’s promise to increase tariffs is also likely to have some effect on businesses here, although the RBA believes it would be “small.”ix And, the wars in Ukraine and the Middle East are also likely to continue to contribute to instability.

Share price volatility is expected to continue as investors roll with the global political and economic punches, and the upcoming Australian Federal Election is likely to introduce uncertainty until the results are in.

If you’d like to review your goals for the coming year in the light of recent and expected developments, please don’t hesitate to get in touch.

Note: all share market figures are live prices as at 31 December 2023 and 2024 sourced from: https://tradingeconomics.com/stocks.

i Why 2024 is a record year for elections around the world | World Economic Forum

ii The economy and markets will boom under Trump | AFR

iii Australian dollar now at risk of plummeting to pandemic-era lows | ABC News

iv Consumer Price Index, Australia, September Quarter 2024 | Australian Bureau of Statistics

v Australian economy grew 0.3 per cent in September Quarter | Australian Bureau of Statistics

vi National home values record first decline in almost two years | CoreLogic Australia

vii Shedding Light on Uncertainty: Using Scenarios in Forecasting and Policy | Speeches | RBA

viii Statement by the Reserve Bank Board: Monetary Policy Decision | Media Releases | RBA

ix The Ghost of Christmas Yet to Come | Speeches | RBA

Information contained in this document is considered to be true and correct at time of publication. In addition, the information provided is general information only, and does not take into account any individuals’ objectives, financial situation and needs. Before acting on any information contained herein, you should consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs.

The team at Clear Sky Financial are extremely good at what they do and their customer service is amazing.